There seems to be some confusion about what player account segregation means and how this all plays out in the recent DOJ action seizing bank accounts and poker sites being unable to pay back players.

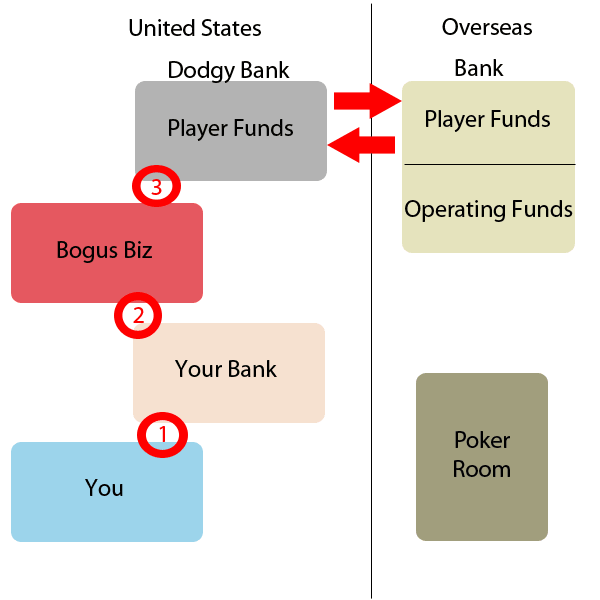

Please consider the diagram below. It’s a very simple version of how payment processing works (or did work up until April 15). What the sites were doing was more complex but this should be simple enough so that people can easily see what is happening.

On one side you have what’s going on in the United States and on the other side you have what’s happening overseas. Now let’s just follow a hypothetical deposit request to this fictional poker site located overseas.

Please note the steps, 1, 2, and 3. At Point 1 you are essentially asking your bank to send money to some Bogus Biz that the poker room has set up to look like a legitimate company. In reality the Bogus Biz is requesting it but this isn’t an advanced course in payment processing.

At Point 2 your bank authorizes the transaction because Bogus Biz claims that it sells flowers online or some other BS. At Point 3 the funds clear and end up in the bank account of Bogus Biz.

From there money goes back and forth to the Poker Room’s legitimate overseas bank account where it segregates your player funds from their operating funds.

Now, that doesn’t guarantee that any of the poker room actually segregated their player funds. They could have commingled funds. However, I wanted to point out that having difficulty making cash outs and commingling are not necessarily the same issue.

Now, here’s where the problem comes in. It’s expensive moving that money back and forth between the legitimate bank and the Bogus Biz bank account. You might be taking currency hits in each direction, transaction fees, etc, etc. Plus the constant transfer of funds might look like money laundering so the Poker Room decides to keep a healthy amount of the player’s money in the bank account of the Bogus Biz so that when players request cashouts and such they don’t have to transfer money back and forth between the legitimate bank and the bank of the Bogus Biz.

And it’s not really all that ominous when you think about Bogus Biz’s bank account like your PayPal account. If you run a business and allow your customers to purchase a 1 year subscription to your website and they pay you via PayPal do you immediately transfer the money to your bank account as soon as you receive it (even if you keep the funds segregated in case of chargebacks, cancellations, etc)? More likely you keep a “working” balance in the PayPal account in case another subscriber cancels his subscription or in case any charge backs or other refunds need to be processed.

And most eWallets like Neteller, Moneybookers, etc work the same way. Money goes in and out all day long and at the end of the day the balance of deposits and withdrawals is deposited into the poker room’s eWallet account. Again, it’s not uncommon to keep a large balance in case one day you have more withdrawals than you do deposits.

So what happens when the DOJ seizes the bank account of Bogus Biz? Technically the funds were segregated but they’re in the hands of the DOJ. This becomes a cashflow issue for the Poker Room now depending on how much they were holding in the United States in banks associated with bogus companies.

My guess is that the reason why Full Tilt and Cereus are having problems paying players back right now is due to how much was tied up in US players. Full Tilt had 30% – 35% drop in cash game players right after Black Friday and UB/Absolute was something closer to almost 50%. Whereas PokerStars was about 25%-ish.

That leaves someone like PokerStars with less overall exposure. They can dip into operating funds and pay out players. But the larger the percentage the more difficult it is to dip into the company’s pockets and hope and pray you get the money back from the DOJ sometime down the road. Just the other day the PPA’s John Pappas estimated that US players have anywhere from $100 million – $500 million tied up in the indicted poker sites. Let’s say that $250 million is the total exposure. PokerStars might be able to swallow $100 million or so from operating funds to pay off players but Tilt might be scrambling to figure out how to put together that kind of cash (this is just a guess). It’s also why the outlook for UB/AP looks so bleak. I don’t think with all of the problems they’ve been having, the mass layoff of staff, etc that they’re in a position to cover the player deposits from operating funds.

I don’t know whether Pappas’ comments cover this but everything that the player holds in the account including frequent player points, bonuses, tournament tickets, etc all have cash value. While a site may segregate cash it’s a completely different issue whether or not the cash to cover all of those other items were completely segregated from operational funds.

I’ve seen other sites discuss this as if the domain-use agreement (or possibly even other agreements) Stars and Tilt signed with the US gave them back access to the money seized in the bank accounts if they could prove that they were player funds. This is supposedly how PokerStars is able to pay players (which I don’t believe). I’ve got the Full Tilt agreement in front of me and there is no such provision. The closest it even comes to any of that is saying that it does not prohibit Full Tilt from refunding player money. In other words, no new charges will be brought for returning player funds. It says nothing about releasing any seized funds to facilitate that. Nor have the DOJ or any of the poker rooms announced that any funds have been or will be released by the DOJ that I’m aware of. In fact, Full Tilt said in their press release regarding the domain-use agreement “the government has not agreed to permit any of the seized player funds to be returned to the players.”

Also keep in mind that many of the bank accounts frozen or seized by the DOJ were explicitly designed hide the true nature of the transactions. So it’s highly doubtful they labeled any accounts as “player” accounts when their bogus business was supposedly selling flowers online. It’s all fine and dandy that you segregated your player funds back in Isle of Man (or Dublin or Costa Rica) but the DOJ seized the bank accounts of Bogus Biz.

Here’s the relevant text from Full Tilt’s press release about the domain-use agreement:

In addition, the agreement represents an important first step towards returning funds to U.S. players because it allows Full Tilt Poker to utilize its domain to facilitate the withdrawal of player funds. But, unfortunately, there remain significant practical and legal impediments to returning funds to players in the immediate future. As a result of the recent enforcement action, there exists no authorized U.S. payment channel through which to make refunds; Full Tilt Poker has no accounting of the millions of dollars of player funds that were seized by the government; and the government has not agreed to permit any of the seized player funds to be returned to the players. Finally, there are numerous legal and jurisdictional issues that must be considered before poker winnings can be paid out to players throughout the United States. While Full Tilt Poker continues to believe that online poker is not illegal under federal law or in 49 states, the indictment and civil forfeiture action filed last Friday require Full Tilt Poker to proceed with caution in this area.

As Grange95 points out in this CrAAKKer article, Full Tilt has to meet other requirements to keep their license. For instance:

Poker sites are required to maintain certain financial ratios, including total assets of 25% in excess of total liabilities [(TA-TL) / TL > 25%], current assets greater than current liabilities, and cash greater than amounts due customers.

I always found the wording in the press release a little strange but this could be the reason behind the phrase “there are numerous legal and jurisdictional issues that must be considered before poker winnings can be paid out to players…” There might be Alderney Gaming Commission asset ratio requirements that they would fall below if they paid out their entire US customer base using operating capital.

I want to stress that all of that is speculation. I have no proof whatsoever other than the fact that the US DOJ basically gave Full Tilt a free pass to return player funds but Full Tilt is hedging in every way possible. I’m just looking into probable reasons why PokerStars was able to get their refunds up and running fairly quickly while Full Tilt said that their remained “significant” impediments to returning funds to players in the “immediate future.”

Sure, I’ll give you that it is a logistical nightmare. It’s not like anybody built in a “Refund Everybody Their Money” feature into their software platform. But I know it was only 2 or 3 weeks between when the UIGEA was passed in Congress and when it was signed into law on Oct 13, 2006 and Party was ready to begin processing payouts almost immediately. Sure, it might take a week or two to figure out what the cash value of this or that is and to make sure that you apply a fair value to everything but it’s not impossible. It’s not a reason to issue a press release hedging on when you’ll be able to pay out customers. If it was simply a logistical problem then you can issue a press release that says, “Although we’ve struck this deal with the DOJ we still need about 2 or 3 weeks to figure out how points, tournament tickets, pending bonuses, etc will be handled. Once we get that all figured out we’ll beging the cashout process for US players.”

It’s also telling that despite posting updates on 2+2 (which I’ve criticized as probably only 10% – 20% of their players read the forums regularly and are thus completely in the dark about what’s going on) on 4/28 (which was a full week after they signed the domain-use agreement) and 5/5 they’re still giving uncomfortably vague answers. For instance, on 4/28 FTPDoug said:

1. Any estimate on when we [US players] can begin cashing out?

– Here’s the official statement about this question: “Full Tilt Poker is diligently working on return of US Players funds which is a top priority and will have a further update for US customers by early next week.”

And his next update on 5/5 he posted again saying:

We are continuing to work on facilitating the withdrawal of US Player funds. It remains our top priority, and we do apologize for the delay.

The fact that neither FTP nor UB/Absolute will specifically define what is holding up the payouts is why I indulge in speculating beyond simple logistical issues. If it was an issue with finding a payment processor in the US who will do business with them then why not say that “We’re negotiating with banking relationships in the US that will allow us to transfer funds.” The fact that this very important but simple question keeps getting skirted is very troubling and makes one wonder what is really going on.

Realistically, the only thing holding Full Tilt (or AP/UB) from refunding player balances today are:

1. All of their banking relationships are burned and they’re frantically looking for new ones.

2. They have logistical issues making sure players are fully compensated for points, bonuses, etc.

3. They have cash flow issues which have them scrambling for a capital infusion.

Which of the above is the most likely reason for overly vague updates about when players will receive funds?

Unlike UB/AP which is probably bankrupt, I think that Full Tilt is simply in a cashflow bind. Players are likely to get their cash back. My gut says that Full Tilt needs to work out how they’re going to lose all of that cash so rapidly and still maintain their liquidity ratios for gaming regulators.

Am I sure of this? No. But the evidence seems to support this thesis more than other possibilities.

@Baerrus: I don’t assume that. In fact, I think it’s a major flaw in the licensing models. Any gambling authority should have the backing of the state so if FTP or someone was to file a false financial statement they would be in violation of criminal laws against the state (including perjury).

The other major flaw, especially with the AGCC, is that only the servers have to reside in the jurisdiction. Gibraltar, IoM, and a few others require all key personnel reside in their jurisdiction as well. So, a few years back if you were running a French poker room licensed in Gibraltar your key executives had to be based in Gibraltar.

This is key in terms of enforcing gambling laws just like any other state law. If they can just launch a raid and arrest you for signing off on bogus financials it tends to up the cost of being a crook. It also gives them stuff to seize.

If the AGCC wanted to go after FTP, what can they grab? Some servers? FTP can be up and running in another data center in a few hours. But if Ray Bitar owns a $5 million home, bank accounts, etc all in Alderney then it gets interesting. He might be able to make it off the island but the AGCC can grab his assets held in the country.

It sounds like you assume here that regulators like AGCC have some kind of supernatural instant and complete visibility into *all* financials of its licensees. The reality is that regulators get only voluntarily submitted information from licensees. Thus possibility of fraud, under or mis-reporting are still very real (as we learned with FTP). I thought about it quite a bit. The only real guarantee is still reputation and integrity of the people running poker sites. Crooks will be crooks no matter how tight you “regulate” them.

Btw, there may be a place for an insurance product where A+ rated insurer would insure player’s funds. Absence of such products does not speak well of online poker industry.

Cheers,

@Baerrus: Thanks for the update. I think the AGCC CEO is legally correct but what he said doesn’t address the issue that companies would be much less tempted to use player funds for operational expenses if they are segregated and it’s much easier for regulators to notice irregularities if the funds are segregated.

Bill,

CEO of Alderney Gambling Control Commission spoke out recently. The question of player’s fund segregation was the most insightful bit of otherwise dull interview (see video and my post at http://blog.nexuspoker.com/2011/10/no-more-rush-poker-gambling-chief-talks.html).

Basically he said that while “fund segregation” sounds very good, in practice, in most countries senior creditors have a claim on all bank accounts of the entity in question (FTP). Which is another way of saying that “fund segregation” is not a proven financial mechanism for protecting players deposits in case of default, fraud or bankruptcy.

Take it with a grain of salt of course, because AGCC has its own arse to protect.

Stephen,

You are correct, The Isle of Man has very strict rules regarding regulation. Pokerstars had to keep player funds separate from company funds. My personal belief is this is the reason why they could pay players back so quickly. They had things well organized and could prove certain accounts were player funds. From my understanding the Isle of Man also met with the DOJ to explain how their regulation works and show which accounts were player funds.

As for FTP and AP, I have no idea how they are regulated, but it does seem like all funds were co mingled.

My question going forward is what are Merge and Cake skins doing about keeping player funds in a separate account.

Easy solution incoming: 50 states, 52 cards in a deck… Assign each state a random card, and the 2 leftover cards can represent a lull in payment processing. Use the random # generator to select 5 states and PAY THEM! Announce when this is expected to take place so people arent spamming their terror all day and night long ( to no avail). Once you have the initial 5 states paid deal out another 5 states and PAY THEM. Repeat til we are a done deal and close the site for USA altogether. YAY Everyones happy in the end !

The poker community has now waited nearly a month for this river card to come down. Why make us ALL sweat, instead of paying some at a time as money comes in? GG

P.S. If you are non USA and you don’t need your poker funds to eat , pay rent, hospital/doctor, funeral bills ect. please stop trying to withdraw?!!?!?!?! It would appear a) sites have enough to do already b) theres less staff available right now and this is creating a longer timeframe for everybody involved. c) you don’t need that $ anyway persay. D) if you break the camels back with your 1 straw the ENTIRE POKER COMMUNITY WILL SUFFER including you. E) It doesnt make any sense to attempt withdrawals ( from AP/UB)right now when theres a limit on them anyways at this time (do you really want to withdraw between 2 and 300,000 times to get the entire roll or just wait til they can pay the whole amount in 1 shot? F) If and when USA gets paid out business should in theory return to normal at some point down the road for non USA if youre patient.

Let me rephrase: they were minimizing what they were keeping in US channels.

@Lin: How do you think they processed deposits? The indictment laid out a pretty clear picture of how they had money in the US via bogus companies and such.

Just a follow-up: the last several checks I received from PS were drawn (in dollars) on Canadian or east Asian accounts. The last one I got before Black Friday was DHL’ed from Singapore. It’s been a long time, at least a couple years and maybe longer, since I got a PS check from a US bank. So I don’t think PS had much money located in the US.

It’s my understanding that the Isle of Man has much stricter segregation requirements than those that Full Tilt and Cereus had to cope with, so there actually was money held in trust in an offshore bank for players when Pokerstars started processing cashouts. Accounts seized in the US then would have hit operating cash and profits, but there was always money to pay out.

If Full Tilt was keeping money with payment processors, given the large percentage of US players they had, they may simply be unable to pay out for months, or ever. Earnings from much smaller operations (losing 40% or more of their player base) may not be able to cover the shortfall. If they haven’t paid out yet, I would guess that they didn’t stockpile emergency cash like had been rumoured. Bankruptcies happen all the time to companies that hit a liquidity crunch like this.

Bill: I’m kind of thinking Stars had been planning for this all along. They had started marketing aggressively outside the US even before UIGEA passed, and the amount of PS advertising on US TV had gone down noticeably in the past couple of years – they used to be all over just about every cable sports channel, but had recently gotten to the point where they were buying time only on the poker shows any more. Also, the speed with which they were able to refund player moneys, including converting T$, W$ and FPPs to cash, suggests the software was already in place, or at least ready to be deployed, and it was just a matter of getting something worked out with the DOJ.

Cris: I just checked the PS lobby. 212,000 players on 33,118 tables. I don’t think you have anything to worry about.

@Cris: Well, I’ve told you what I know. What I find risky you might be okay with. What I find too risky you might be okay with. It all matters what your risk tolerance is.

Everybody has to make their own decisions.

Good article, mate. However the issue remains, is it safe for European players to keep playing on the 3 sites, or should safety prevail and search for the edge on EU sites?